indiana excise tax deduction

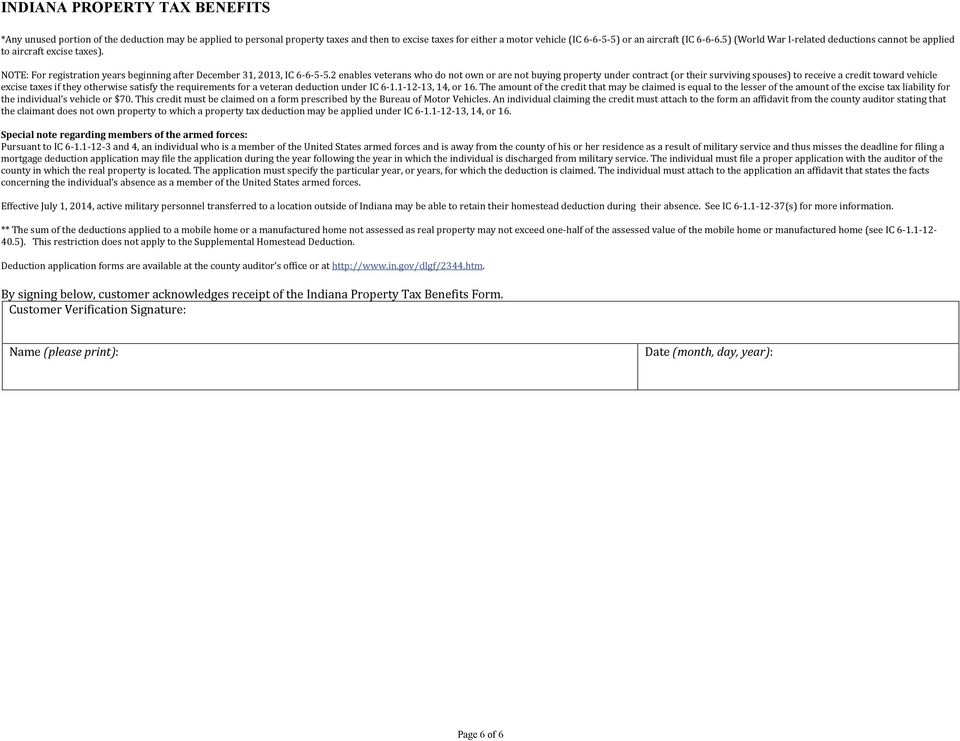

The IRS only allows that portion of a. Veterans or their Spouse that are eligible for any of the deductions above but the assessed value of their.

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

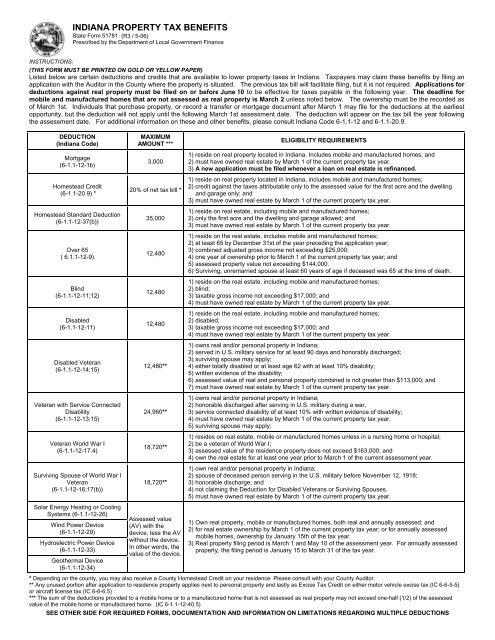

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property.

. A portion of Indianas vehicle registration fees are tax deductible. You paid property tax to. This type of equipment was previously subject to personal.

This includes things like fuel taxes and excise taxes. Wartime Indiana veterans may deduct even morenearly 25000. The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana.

If you have sold or destroyed total loss a vehicle you may apply to receive a creditrefund of a portion of the Indiana vehicle excise taxes by submitting Application for Vehicle Excise Tax. The rental excise tax is 225 percent of the gross retail rental. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000.

Model year 1980 or older passenger vehicles trucks with a declared gross. Application for deductions must be completed and dated. A portion of Indianas vehicle registration fees are tax deductible.

Lake County Residential Income Tax Credit. Vehicle Excise Tax Flat Rate 12. All Indiana veterans may deduct 14000 from the value of their home before calculating property taxes.

MOTOR FUEL AND VEHICLE EXCISE TAXES CHAPTER 5. 1 2019 Indiana implemented a new excise tax on the rental of heavy equipment from a location in Indiana. My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee.

2018 Indiana Code TITLE 6. It is based on the value of vehicle. But this amount is actually called an excise tax and not a property tax.

The per-gallon rates are as follows. SOLVEDby TurboTax926Updated December 23 2021. If your business rents heavy equipment youll need to register and collect a 225 heavy equipment rental excise tax.

A veteran who owns a vehicle and is entitled to a deduction under IC 6-11-12 sections 13 14 or 16 and has any remaining deduction from the assessed valuation to which the person. Taxpayers are eligible to take a deduction of up to 2500 for Indiana property taxes paid during a tax year on the individuals principal place of residence. But this amount is actually called an excise tax and not a property tax.

A portion of Indianas vehicle registration fees are tax deductible. The amount of the Indiana County Income Tax shown on Form IT-40 line 9. Motor Vehicle Excise Tax.

The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A. Many of our county veterans. Vehicle Excise Tax Deduction for Disabled Veterans.

The excise tax credit is equal to the lesser of the excise tax due for the specific vehicle or 70 and can be applied to two vehicles owned by the veteran. Generally excise taxes cant be deducted on your personal return. Social Security Income Deduction.

The IRS only allows that portion of a. But this amount is actually called an excise tax and not a property tax. You may be able to claim a credit if.

Justia Free Databases of US Laws Codes Statutes.

Indiana Property Tax Benefits State Form R11 4 14 Prescribed By The Department Of Local Government Finance Pdf Free Download

Indiana Cigarette Tax Hike May Increase Cigarette Smuggling

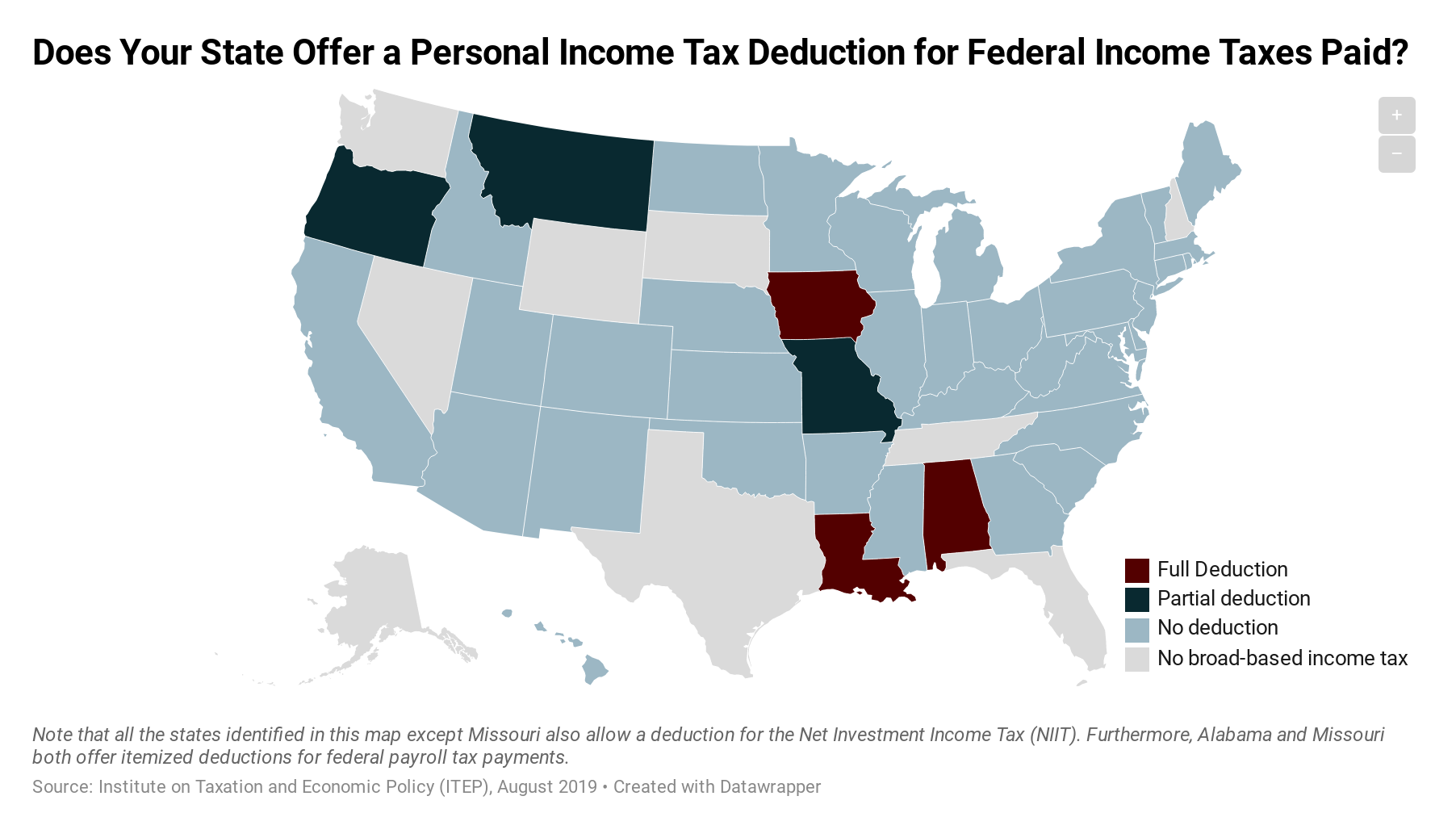

Which States Allow Deductions For Federal Income Taxes Paid Itep

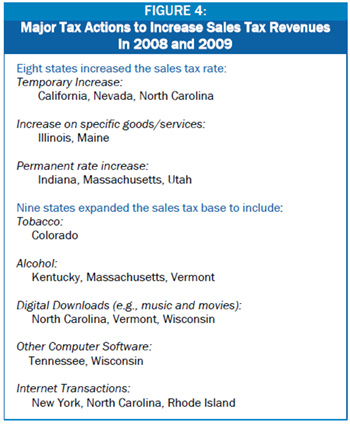

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

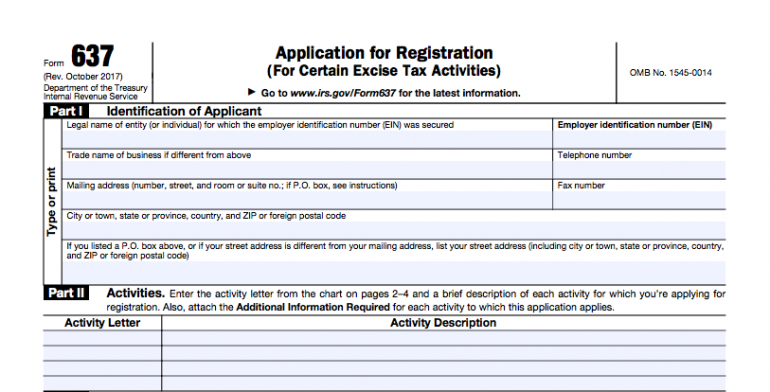

3 11 23 Excise Tax Returns Internal Revenue Service

What Part Of My Indiana Vehicle Registration Fee Is Tax Deductible Sapling

Porter County Auditor Facebook

Deducting Property Taxes H R Block

Vehicle Title Tax Insurance Registration Costs By State For 2021

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

Excise Tax In The United States Wikiwand

Indiana Property Tax Benefits State Form 51781 Town Of

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Excise Taxes Excise Tax Trends Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Online Sales Tax In 2022 For Ecommerce Businesses By State

1952 Indiana Department Of State Revenue Gross Income Tax Bonus Tax Forms 1040 Ebay

Bills That Need Our Help Archives Dav Carlos Arambula Chapter 102